![]()

The non-financial and sustainability reporting has become one of the pillars of the strategic management of companies, both in Spain (where the publication of non-financial information is mandatory for companies with more than 500 employees) and in the rest of the world.

These reports gather information on the company, not only from an economic point of view, but also on sustainability management, ranging from aspects such as climate risks to the contribution to the Sustainable Development Goals, including human talent management and work-life balance, o social indicators, good corporate governance, etc.

The preparation of an annual report requires the collection of all types of social, environmental, economic, etc. data and indicators. To do this, companies often rely on digitization and have software solutions that help them collect and consolidate all the data, and then use it in their responses to the various reporting frameworks, including internal controls for reliability, verifiability and traceability.

The first step is to analyze and organize all the information to be presented in a report.

Main reporting standards

![]()

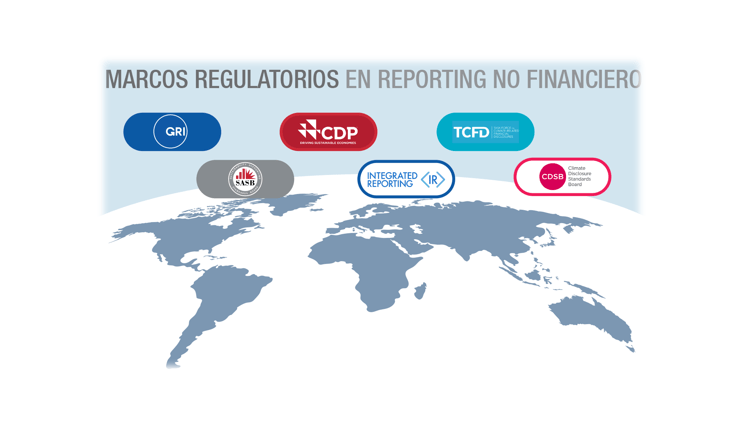

The vast majority of companies rely on international standards to prepare their sustainability reports. Thus, the best known regulatory frameworks at the international level, which will be discussed in this article, are as follows:

- GRI

- CDP

- TCFD

- SASB

- IIRC

- CDSB

While these are the most widely recognized international standards, there is a wide proliferation of sustainability reporting initiatives: there are currently close to 400 reporting initiatives in 64 countries.

This wide range of possibilities for publishing non-financial and sustainability information makes it complex for some companies to compare and study.

In this context, five major international benchmark organizations in sustainability reporting systems have recently joined forces to create a single reporting standard.

CDP, CDSB, GRI, IIRC and SASB have set themselves the challenge of creating a single standard reporting model to connect sustainability data with financial information. In this way, different regulatory frameworks would be brought together and their coexistence in reporting would be achieved.

The choice of reporting frameworks to be used is a decision that is also influenced, for example, by the demands of stakeholders or the information that may be of most relevance to investors. These are the main regulatory reporting standards or frameworks:

CDP (Carbon Disclosure Project)

More focused on the investor, reporting based on CDP guidelines facilitates the collection of information on risks and opportunities related to climate change and, therefore, data related to emission reductions, corporate actions to mitigate climate change and reduce environmental impact, etc.

IIRC(International Integrated Reporting Council)

IIRC provides guidelines for the development of an integrated reporting model that includes information on the organization’s capitals (its resources and relationships) and explains how it interacts and impacts the environment and capitals with the objective of creating value in the short, medium and long term.

CDSB (Climate Disclosure Standards Board)

The standard offered by this organization is more focused on investors and the financial market. Thus, organizations that advocate integrating this regulatory framework into their annual reports align environmental and natural capital information with financial reporting.

SASB (Sustainability Accounting Standards Board)

With the focus on regulators and investors, it is more focused on providing financial and operational information of the entity necessary for investors’ decision making.

SASB standards allow reporting sustainability information, incorporating ESG criteria with respect to a wide range of topics including:

- Environment

- Capital stock

- Human Capital

- Business model and innovation

- Leadership and governance.

GRI

This international institution was the first to create a global standard for sustainability reporting guidelines. It is currently a benchmark and most companies and organizations use its guidelines as a basis for preparing their annual sustainability reports.

Reporting according to GRI standards is focused on stakeholders and offers the opportunity to evaluate the economic, environmental and social performance of organizations.

TCFD (Task Force on Climate-related Financial Disclosures)

The TCFD guidelines are a benchmark for organizations wishing to assess and report on the actual and potential impacts of climate-related risks and opportunities on the organization’s business, strategy and financial planning. The recommendations focus on four key areas that are relevant to virtually all types of companies: governance, strategy, risk management, and metrics and objectives.

In order to respond to each of these aspects, each company must analyze the issues that are relevant to its business, which is called its materiality map.

![]()

At present, the different regulatory frameworks coexist and have their own target audiences. Each company or organization chooses the standard to guide its reporting based on its interests, needs and stakeholder expectations. In fact, many organizations advocate incorporating different regulatory frameworks in their annual reports.

On the other hand, there are also some voices calling for the unification of standards in order to provide a single integrated information or reporting framework that connects aspects of financial disclosure with reporting on sustainability indicators, etc.

As a result, companies have a responsibility to make their ESG disclosures increasingly transparent and of high quality. Investors see a correlation between long-term profitability and corporate transparency, so keeping abreast of trends in reporting, metrics, management tools, etc. are aspects that those responsible for these reports should have at the top of their priorities.

If you would like more information on these topics, please contact Salvador Lara Commercial Director of Laragon by calling +34 664.473.524 or by email: [email protected]