The 7 sins of ESG management

The following are some of the most common misconceptions and problematic practices among companies when dealing with ESG management, which can lead to major pitfalls. The common element in several of these practices is the lack of a purpose-driven strategy that focuses on company-specific material issues and is fully integrated with the organization’s business objectives. As discussed above, developing an effective ESG program requires a conscious effort that is led by the board of directors and management and communicated throughout the company.

SOURCE : The Seven Sins of ESG Management Posted by Kosmas Papadopoulos and Rodolfo Araujo, FTI Consulting, on Wednesday, September 23, 2020

![]()

- Excessive attention to qualifications

Some companies believe that improving their ESG position means an improvement in their ratings by ESG rating agencies. A business approach focused solely on improving the company’s rating runs the risk of allocating more resources to “ticking boxes” rather than developing a strategy that is tailored to the company’s unique perspectives and risk exposure.

ESG ratings can be useful for companies to understand potential perspectives on material issues, but they only represent specific third-party views. In fact, the multiple rating methodologies available on the market make it almost impossible to satisfy all points of view.

Positive ratings can indeed help a company gain recognition, but they should be considered only as the result of the company’s efforts. It is important for companies to focus on their own perspective on how to manage their material ESG risks and opportunities and to use the views of third parties as inputs, not as ends in themselves.

- TrESG as a communication effort only.

Companies sometimes make the mistake of trying to improve their image by focusing solely on their communications and public relations strategy, thus “putting the cart before the horse” in their ESG efforts.

Communications can help the company amplify its message, but they cannot replace a sound management system that addresses material risks. Investors and other stakeholders may see through messages that do not correspond to meaningful action (often referred to as “Green Wash”).

More importantly, by focusing on the message and not on the management of ESG issues, the company remains exposed to significant risks.

- Lack of oversight by the board of directors and management

Some companies delegate ESG or sustainability responsibilities to individuals or departments within the company, without the involvement of the board of directors and senior management. However, the company’s ESG management strategy must be positioned as a fundamental part of the company’s vision and values. Therefore, it is imperative that the board of directors and senior management not only oversee, but drive the company’s ESG strategy, fully aligning it with the broader business strategy.

- Designing the business strategy

An ESG strategy cannot be thought of separately from the company’s business strategy. An ESG strategy that does not take into account the company’s strategic objectives and does not inform the core corporate strategy does not fulfill its purpose. These disconnects may be due to possible misperceptions about the purpose of the ESG program, lack of oversight by the board of directors and management, or failure to conduct a thorough materiality assessment.

- Compliance-oriented approach

Some companies may present their ESG program by referring to compliance with environmental, labor practices, health and safety, and other key issues. This approach may appear reactive and indicate a reluctance to go beyond the minimum requirements.

To position themselves as leaders, companies would need to illustrate that they proactively establish best-in-class programs that exceed minimum requirements as part of a deliberate ESG strategy. At the same time, in jurisdictions with strict rules and regulations, it is important that companies fully explain their practices so that they get full credit for their efforts. Otherwise, your audience may not fully appreciate that the company is operating at a high level.

- Inconsistencies in the company

As a result of a lack of enterprise-wide strategy and coordination, or operations in disparate jurisdictions, geographies or business segments, some companies may end up adopting different standards in different divisions without a clear rationale for discrepancies in business practices. This approach leaves significant gaps in the company’s ESG management programs, with consequent exposure to risk.

In these cases, companies should map their policies and programs across business units and geographies and harmonize efforts across the enterprise to have a consistent approach with equivalent practices on how to address material risks.

- Lack of evaluation and follow-up

Collecting data and information to monitor performance on key ESG issues is a major challenge for companies in implementing their ESG programs. The lack of effective ESG performance monitoring prevents the company from making progress and receiving full credit for its ongoing initiatives through reporting.

Setting up the mechanisms and methodologies to collect the appropriate information for monitoring results can be a considerable effort at the outset. However, such a process can be decisive in establishing a successful program.

In addition to a review of data, the monitoring process should include an ongoing assessment of the effectiveness of the company’s programs so that systems can be adjusted for continuous improvement.

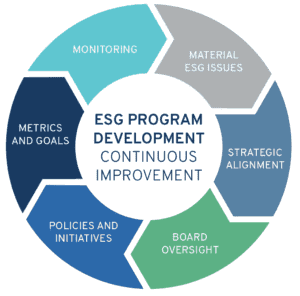

Six key elements should be considered as companies develop their ESG program: monitoring, materiality of ESG issues, strategic alignment, board oversight, policies and initiatives, and metrics and targets.

As we can see, the digitization of key processes linked to the achievement of ESG objectives is becoming a priority in companies’ investment policies. Having the key market-leading tools with which today’s leading companies that are pioneers in best practices for these objectives are working should be an option to be considered by companies that do not want to be left behind.

At Laragon Sustainability we have been a benchmark in the digitization of many of these initiatives for more than 15 years, providing companies of all sizes with our experience in optimizing all company processes towards sustainability, transparency, risk management and good governance.